Diary of a Brand: Moncler

The playbook for turning a product into a luxury good

High end coat brands Moncler and Canada Goose have a lot in common. Both were founded in the 1950s (Moncler in 1952 and Canada Goose in 1957), and both expanded with the help of private equity in the 2000s. Both companies later IPO’d within four years of each other, Moncler in 2013 and Canada Goose shortly after in 2017.

However, one brand is worth more than 10X as much as the other.

While Canada Goose has focused its brand on the technical features of its product (fabric innovations, associations with arctic temperatures), Moncler CEO Remo Ruffini focused on transforming Moncler into a luxury brand, turning a puffy coat into a fashion item on par with a Cartier bracelet or Hermès handbag.

Why choose luxury over technical superiority as your brand strategy?

For one, luxury allows you to charge much higher prices. No one will question if the technical aspects of a Chanel handbag warrant a 5K price. It costs that much because it’s Chanel.

Second, luxury brands are able to easily sell across categories by simply adding their logo. Moncler can sell consolation products like scarves and fragrances to customers who want access to the Moncler brand without investing $2,500+ in a coat. For Canada Goose, whose brand is more rooted in performance, the team must back up each accessory with technical features.

Finally, luxury drives repeat purchase. Do you need two highly technical, arctic-worthy Canada Goose ski jackets? Probably not. Do you need multiple luxury items? You wouldn’t want to be caught in the same Moncler outfit on two ski weekends…

To be fair, Canada Goose is successful in its own right. But in this Diary of a Brand — I want to focus on Ruffini’s Moncler — and what other brands can take away if they are looking to leverage luxury as their brand strategy.

How did Remo Ruffini turn a puffer coat into a luxury good?

Let’s start with Ruffini’s history. The Moncler CEO grew up in Italy around the fashion industry. Both of his parents owned clothing companies, and he recalls learning the business at a young age:

“My parents discussed work at dinner, so I was always talking about fabrics, about runway shows, about production, about PR, from the time I was tiny.”

- Remo Ruffini, W Magazine

But in addition to understanding the business of fashion, Ruffini possessed a remarkable talent for sensing trends and matching those trends to a yet-unaware market. Case in point, Ruffini’s first venture. His parents sent him to Boston to receive an American college education. However, upon discovering the preppy style of dress in New England, Ruffini decided to start a business instead:

“When I got to Boston, I discovered preppies, Hyannisport, the Vineyard…there was a culture that I could communicate to an Italian consumer. This was a powerful emotion. It helped me come to the turning point of saying, ‘I won’t go to college — instead, I’ll start working.’ ”

- Remo Ruffini, W Magazine

Ruffini went back to Italy, and, with his mother as mentor, launched ‘New England,’ a brand that merged Boston prep style with Italian tailoring. Ruffini sold his stake in New England in 2000, and set his ambitions on reinvigorating a heritage brand:

“I said to myself that it could be interesting to work with something that had strong roots, and then try to be more innovative, to develop the idea but to remain consistent.”

- Remo Ruffini, WSJ

He found that opportunity in Moncler. Like Canada Goose, Moncler had the potential to be a leading technical brand. The founders had won patents for improving cold weather garments with thermal down. And the brand had a storied history of outfitting explorers and French Olympic skiers.

In 2003, however, Moncler was teetering on the verge of bankruptcy. Ruffini had been working for the brand since 1999 as creative director. According to the Wall Street Journal, Ruffini and his private equity partners bought the brand ‘for a song’ and he assumed the role of CEO in 2003.

From there, Ruffini set about transitioning Moncler from Olympic ski jacket to luxury fashion. I organized Ruffini’s strategy into a new framework: the Luxury Brand Strategy model. It’s simple, with only two phases (three if you are starting from scratch) to allow for a focus on outcomes and flexibility in execution.

Luxury Brand Strategy Step 1: Increase aspiration.

It was not enough for the Moncler brand to offer functional benefits; luxury brands must also deliver emotionally. Typically emotional benefits come in the form of conveying messages to other people by the act of owning said brand: I am on trend, wealthy, attractive, and/or part of a group that others want to be part of. Brands like Ferrari and Aman hotels already have those associations. To get Moncler there, Ruffini employed three tactics:

(A quick aside: If you’re enjoying this article, consider subscribing to my free weekly newsletter, Branding in 4-D, by clicking here!)

1a. Style

A puffer coat is not a very sexy product. Well, until Moncler. Ruffini updated Moncler’s styles, removing weight from the jackets to make them lighter, and partnered with established designers Junya Watanabe and Nicolas Ghesquière in 2005 to add silhouettes to previously shapeless products. Today, Moncler is credited with elevating coats to luxury-worthy goods:

“The category that used to be a popular splurge was handbags…Right now, that category is outerwear.”

Experts point to Moncler as the brand that instigated this shift.

“Moncler developed more modern and feminine silhouettes in their traditional puffer coats, as well as spearheaded successful collaborations with fashion designers.”

— Racked

1b. Distribution

One of Ruffini’s first orders of business was to remove Moncler from sporting stores (which promoted associations of a technical product). Instead, he forged partnerships with upscale retailers. He also began to open Moncler’s own stores, which gave Moncler control over the experience and location. Ruffini’s first owned-stores opened on the slopes of upscale ski resorts:

“When I started to open stores it was in the ski resorts: Verbier for the English, St Moritz for Americans and Russians.”

— Remo Ruffini, The Brand Gym

In 2008, Ruffini opened a flagship store in Paris’ hyper-luxury Rue Saint Honoré, which solidified Moncler’s image as a member of the fashion elite:

“That [Paris flagship store] was a pretty strong statement, which influenced the customer’s perception of the brand,” he says. “From that moment, we became what we are today.”

— Remo Ruffini, High Snobiety

Today, Moncler stores feel more like museums than retailers. Each corner of the Moncler in Manhattan’s Soho neighborhood features a different style of jacket and accompanying accessories. A few extraordinary coats are showcased behind glass, while a lack of windows and ornate interior design bring guests on a trip to an alternate Moncler universe.

Canada Goose, on the other hand, sells coats. Their Soho store (just a block from Moncler) is reminiscent of the arctic environment their coats are made for.

1c. Fantasy events

Ruffini wanted to associate Moncler with high fashion, and one of high fashion’s top moments are its runway shows. But puffer coats aren’t typically parts of fashion week. Again, until Moncler. To capture the attention of editors, Ruffini staged large scale performances, including a 363-person flash mob in Grand Central Terminal in 2011, an ice skating show at Central Park’s Wollman Rink in 2015, and a marching-band style takeover of Lincoln Center in 2016.

With designers came fashion shows, but the routine stroll up and back on a catwalk clearly wasn’t going to cut it.

-WSJ

These events had an additional benefit beyond putting Moncler on the map: they injected a sense of fantasy in the brand.

Coco Chanel described luxury as ‘a necessity that begins where necessity ends.’ Ruffini’s over-the-top events positioned Moncler past the necessity line. He was no longer selling coats, but an aspiration:

“I don’t want a normal fashion show — I’m after another vision, a different way of showing. I’m not selling a collection, I’m selling an attitude.”

— Remo Ruffini, WSJ

Ruffini’s combination of upgraded style, high-end distribution, and extravagant events positioned Moncler for luxury. But positioning is only half the battle; the other part of brand building is capturing (and keeping) attention. Which leads to step 2…

Luxury Brand Strategy Step 2: Build cultural relevance

Leading brands stay top of mind by leading cultural conversation. It’s no coincidence that Louis Vuitton hires musicians and artists as Creative Director to keep the 170 year-old brand relevant. Or that it-brand Loewe outfitted both Rihanna’s 2023 Super Bowl performance and Beyoncé’s 2023 Renaissance tour.

How does Moncler engineer cultural engagement?

- Well-defined product signature

- ‘Genius’ collaboration program

2a: Product Signature

Collaborations are a way for brands to stay fresh as other designers add their take to your product. But a good collaboration starts internally with a product signature other designers can layer onto. Consider luxury luggage brand Rimowa. The metallic vault style of their suitcases is their signature — and makes a perfect canvas other designers can paint on without losing the essence of Rimowa:

Moncler’s puff panels serve as their signature, making it easy for designers to re-interpret the brand but also convey Moncler across different collabs.

Canada Goose also has collaborations, but their lack of product signature limits their potency. There is no obvious point of view that ties them together. Canada Goose’ various collaborations with Drake’s OVO (October’s Very Own) feel disjointed and lazy, while Feng Chen Wang’s more creative Canada Goose collection lacks a visual tie to the brand.

As further evidence of Moncler’s cultural status, Drake chose to sport a shiny red Moncler Maya jacket in his 2016 Hotline Bling music video (along with iconic brands Timberland and Air Jordan), despite OVO’s ongoing collaborations with Canada Goose.

2b. Moncler Genius

Recognizing collaborations as a source of earned media, Ruffini decided to create an operating structure around brand collaborations.

“The client wants to see something new every day…They’re not going to wait six months to see what’s going on. That means I need a new story every month at least to give news to my customer. So I said, Why don’t we link the whole business to this attitude?”

— Remo Ruffini, WSJ

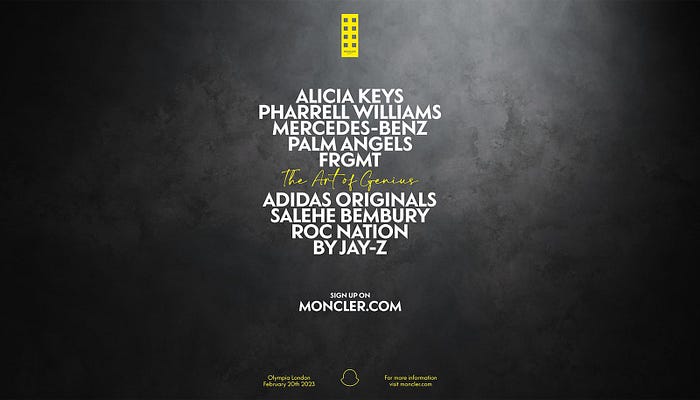

He launched Moncler Genius in 2018 as a rotating selection of designers and brands who reinvent the Moncler puffer jacket every 1–2 months. The project has its own building in Milan, with 8 cells responsible for 8 annual collections.

With Genius, Moncler makes a genius shift of its own from collaborator to platform. ‘Genius’ is now a brand in its own right that designers want to join. The program has also continued to reinvent itself, shifting from a way to riff on the puffer coat to a platform for co-creation across art, music, and events:

Fashion collaborations? They’re so over. Or at least they are for now at Moncler, whose highly regarded five-year Genius project is “evolving from a world of fashion collaborations to a platform for co-creation across different industries”

“I strongly believe in the Moncler Genius model and its perennial development…From today Moncler Genius means, also, art, music, movies, sports and honestly much more.”

— Remo Ruffini, Vogue

As an example, Moncler and Mercedes Benz fused their design languages into a zero-gravity inspired show during London 2023 Fashion Week.

The shift from collaboration to co-creation cements Moncler’s position as an artist rather than a brand. What is more aspirational than art? And, it shows Ruffini’s ability to continue pushing boundaries of marketing.

A new model for luxury brands

Remo Ruffini transitioned Moncler into a luxury brand with two major shifts: one, increasing aspiration with elevated product, distribution, and events, and two, engineering Moncler into a hub of cultural leadership with signature visuals and their Genius platform. These actions have not come without cost. However, they allow Moncler to charge higher prices, sell more product, and potentially lower marketing spends in the long run as attention flows to the brand. Moncler’s gross margin, operating margin, and net income vs Canada Goose all point to this strategy paying off.

A key part of Ruffini’s success may be his position as both creative director and CEO. He is happy to invest in creative decisions (like expensive events) that will take time to pay off:

In private equity, numbers are numbers. They only think about numbers, they don’t always think about what is best for the company, because they go into companies to exit and to invest in another company…

For me it is different. I am always thinking in terms of ten years, twenty years, thirty years.

— Remo Ruffini, Luxury Society

If not money, what is Ruffini aiming toward during all of that time?

In a word, perception.

As stated in his interview with Luxury Society, an investment in the public perception of a brand assures strong financial results in the future:

The future of a company, in my opinion, is linked to the knowledge and the perception of the brand. It could happen that you have a raise, in terms of turnaround, but it’s more important to have a growth of the knowledge: Step by step people have known Moncler as puffy jacket until they came to the point where the real value is the brand recognizable as a quality choice. That’s a kind of investment that assures strong bases for a tangible growth.

— Remo Ruffini, Luxury Society

One of the most common questions I get from my own clients is how to measure return on investment in brand marketing. Tactics like digital ads and discounts can show immediate sales growth. But, as Ruffini implies, financial metrics are a lagging indicator of brand health. Improvement in brand should be measured by perception first.

Moncler and the Brand Flywheel Model

In all of the Diary of a Brand pieces, I evaluate how the brand connects marketing, price, and product to underlying operations. For example, IKEA’s flat pack furniture, out of city locations, and reliance on customers to assemble goods allow IKEA to save costs and invest in a killer offering of good design at low prices.

How does Moncler stack up? Moncler’s model is self-reinforcing — a good sign — and no surprise given their performance.

Price <> Positioning: Moncler’s luxury pricing ($2K+ for a coat, $645 for a beanie) reflect their positioning as a luxury purveyor.

Positioning <> Product: Moncler’s high-end product design, with elevated silhouettes and designer collaborations support a luxury fashion positioning. Elevated store experiences on par with the most premium fashion houses also support the positioning.

Brand, Product, Price <> Operations: Most importantly, Moncler supports their brand strategy with an aligned operating model. Ruffini’s ownership allows for a longterm focus on brand-building instead of short-term sales. Owned stores allow Moncler to craft the experience themselves, while the Genius model entrenches creative refreshment into the brand. The product portfolio both maintains exclusivity with high end coats, while bringing in customers with high margin consolation items like scarves and perfume.

The future of Moncler

What’s next for Moncler? Maintaining relevancy is a challenge for all luxury brands. Even the Genius program will lose energy over time unless Moncler can breathe new life into it. In a December 2022 interview, Ruffini mentioned experiences as the next frontier for Moncler’s cultural leadership:

“You have to be a little bit of a future predictor, if you’re talking 2025, 2028,” he muses. For technology, which changes so quickly, that can be tricky, he admits. But he senses that creating immersive moments in stores, in online videos or elsewhere, like the Duomo happening, will be one path forward. “I think the luxury world has changed from possession to experience.”

— Remo Ruffini, WSJ

Moncler’s history of fantastical events and collaborations sets a high creative bar for anything they attempt in the future. One benefit of running a technical brand like Canada Goose is that you don’t necessarily need to lead culture to grow sales. You just have to lead on product quality. On the other hand, as a culture-leading brand, you have the power to garner attention to whatever you decide to do next. That is, if you’re bold enough to lead the way.

Don’t miss out on brand insights — Sign up for monthly emails on brand marketing.

Looking for help defining how to grow your brand?

I run brand consultancy Embedded — where I partner with companies to grow via distinctive brand strategy.

Not sure where to start? Many clients opt for ad-hoc coaching — hourly consultations on any aspect of your marketing and brand strategy. Get in touch here, or book a 15 minute free consultation.